Solar Costs Savings

HOW MUCH DOES SOLAR COST IN FLORIDA?

According to the U.S. Bureau, prices for electricity were 65.74% higher in 2018 versus 2000. Between 2000 and 2018, electricity experienced an average inflation rate of 4% per year. This rate of change indicates significant inflation. In other words, electricity costing $100 a month in the year 2000 would cost $165.74 a month in 2018 for an equivalent purchase.

If your average monthly power bill was $200 and we factor in the average inflation rate of 4%, you will be forking over $121,450 to the power company in the next 25 years.

Depending on how many solar panels we can install at your address, we can SAVE YOU UP TO $118,150 in the next 25 years by bringing your power bill down to the monthly utility charge of $11!

2022 SOLAR COST SAVINGS BREAKDOWN

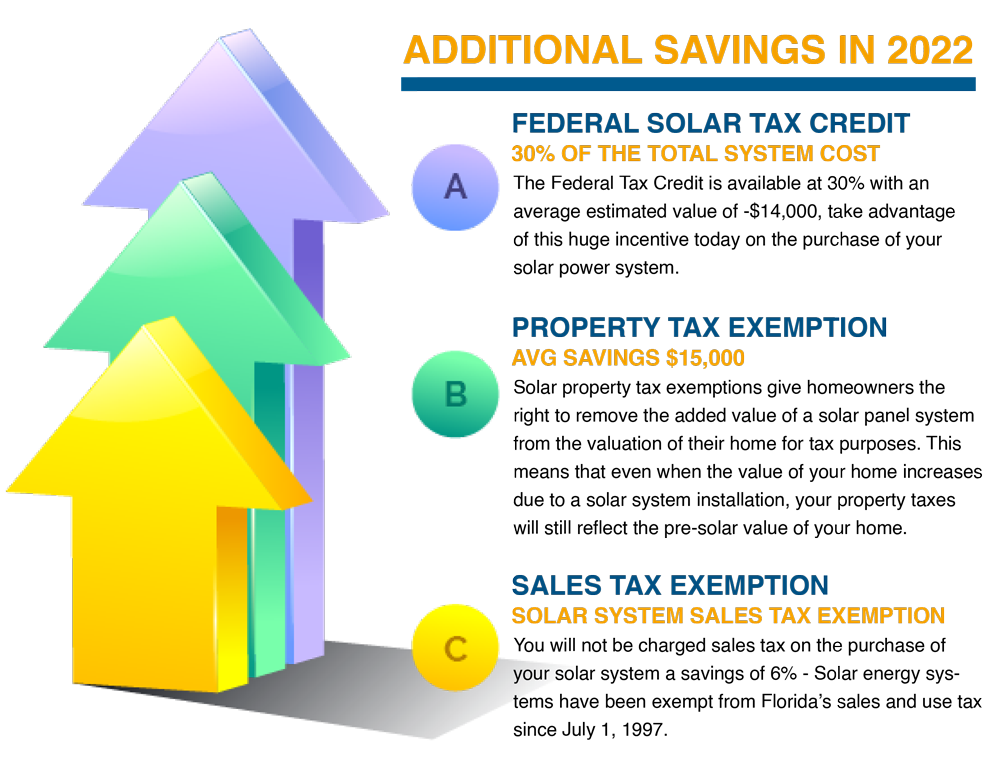

FEDERAL SOLAR TAX CREDIT

The Federal Tax Credit, also known as the investment tax credit (ITC) is currently available, which means that you may be eligible for a 30% tax credit on any solar power installations.

The ITC applies to both residential and commercial systems, and there is no cap on its value. Thanks to the ITC, the average Florida Power Services solar shopper saves over $14,000 on the cost of going solar.

PROPERTY TAX EXEMPTION

Solar property tax exemptions give homeowners the right to remove the added value of a solar panel system from the valuation of their home for tax purposes. This means that even when the value of your home increases due to a solar system installation, your property taxes will still reflect the pre-solar value of your home.

Here’s an example: you install a solar array on your roof that adds $15,000 in value to your property. If your state’s property tax rate is 1.5%, that increase in home value would result in an additional $225 on your property taxes each year.

SALES TAX EXEMPTION

Solar energy systems have been exempt from Florida’s sales and use tax since July 1, 1997. The term “solar energy system” means the equipment and requisite hardware that provide and are used for collecting, transferring, converting, storing or using incidental solar energy for water heating, space heating and cooling, or other applications that would otherwise require the use of a conventional source of energy such as petroleum products, natural gas, manufactured gas or electricity

How Much Does Solar Cost?

Our low APR solar loan programs have monthly payments lower than your utility bill. Take advantage of these limited time offers with interest rates starting at .99%.

OUR RESIDENTIAL GRID TIED SYSTEMS INCLUDE

- HIGH-EFFICIENCY TIER 1 SOLAR PANELS

- ENPHASE INVERTERS

- IRONRIDGE RACKING (AVAILABLE IN BLACK)

- FLASHINGS TO PROTECT AGAINST WATER INTRUSION

- ONLINE MONITORING

- 10 YEAR INSTALLATION WARRANTY

NET

METERING

Net metering provides the greatest benefit to you as a consumer. Under this arrangement, a single, bi-directional meter is used to record both electricity you draw from the grid and the excess electricity your system feeds back into the grid.

ELECTRIC

UTILITY

ADDED PROPERTY VALUE

Homeowners can expect a reasonable increase in their homes resale value. An article in the Appraisal’s Journal showed that a home’s value increases $20,000 for every $1,000 saved in annual electricity which means most systems will have paid for themselves the moment the solar system is installed.

INCENTIVES & TAX CREDITS

Tax credits can provide a substantial portion of the total solar power system cost. You should confirm the availability of the economic incentives and you should consult your tax advisor about the tax credit before you install a solar Photovoltaic system.

With today’s federal tax incentives, there’s no better time to go solar. The federal energy Investment Tax Credit (ITC) allows you to take a tax credit equal to 30% of the total cost of your solar system, and due to the Energy Improvement and Extension Act of 2008, the federal ITC remains available through 2022.

Fortunately, Photovoltaic (PV) technology has matured such that the payback question can now be given a serious answer, backed by 40 years of weather data, solid math, and accounting.

These answers vary slightly by local climate, utility rates and incentives. In the best cases in Florida, the compound annual rate of return is well over 12 percent, the cash flow is positive, and the increase in property resale value more than covers the cost of the PV system.

NET METERING

Net metering provides the greatest benefit to you as a consumer. Under this arrangement, a single, bi-directional meter is used to record both electricity you draw from the grid and the excess electricity your system feeds back into the grid.

The meter spins forward as you draw electricity, and it spins backward as the excess is fed into the grid. If, at the end of the month, you’ve used more electricity than your system has produced, you pay retail price for that extra electricity. If you’ve produced more than you’ve used, the power provider generally pays you for the extra electricity at its avoided cost. The real benefit of net metering is that the power provider essentially pays you retail price for the electricity you feed back into the grid.